Trust in Advice

Research on the Value of Financial Advice

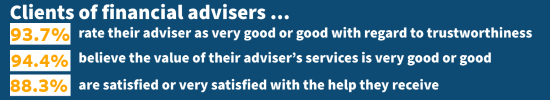

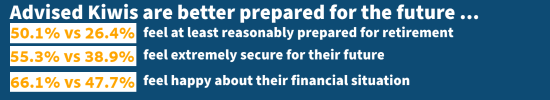

Financial Advice New Zealand believes people who access quality financial advisers are better off than those who don’t. We also believe that quality financial advice leads to a long-term increase in people’s financial health, wealth and wellbeing. But this has been hard to quantify or prove – until now.

The Trust in Advice research report is the result of a comprehensive and independent survey into the value of financial advice. The 2000 person survey quantified the extent New Zealand consumers perceive their experience with a financial adviser as valuable, and showed those who sought advice had an overall better perception of their financial health, wealth and wellbeing compared to those who haven’t.

The Trust in Advice results definitively show advice has high value through its trustworthiness, good consumer outcomes, service, and results (both tangible and intangible) for New Zealand consumers across all demographics.

Mortgage Advice

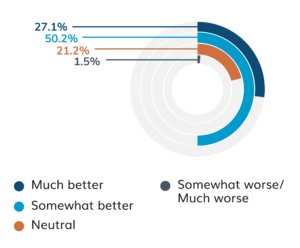

Property ownership is a key financial goal for a majority of New Zealanders and the task of selecting the right mortgage can be a major point of financial stress. However, using a financial adviser to support this decision can alleviate a significant amount of this stress. 72.9% of people who arranged a mortgage through a mortgage adviser believe they have achieved a better overall outcome than if they hadn’t sought advice and 87.8% agree the advice helped them secure the best mortgage for their specific needs.

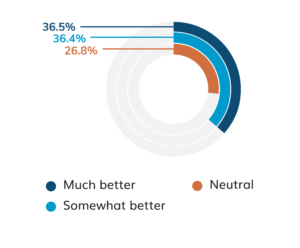

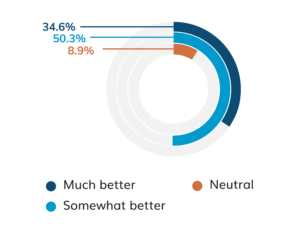

Do you believe you got a better outcome arranging a mortgage through your adviser than if you had purchased directly?

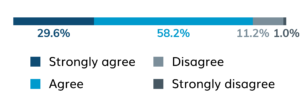

How much do you agree or disagree that receiving mortgage advice has helped you secure the best mortgage for your needs?

Insurance Advice

When arranging personal insurance, a large proportion of New Zealand consumers (84.9%) believe that seeking advice lead them to a better outcome than if they had purchased directly. More than 17 in every 20 customers are satisfied with the service of their provider reinforcing that when insurance is arranged through an adviser, advice consistently facilitates better outcomes – proving its value.

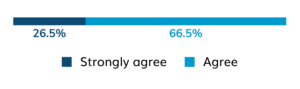

Do you believe you got a better outcome arranging insurance through your insurance adviser than if you had purchased directly?

How much do you agree or disagree that receiving financial advice has helped you secure appropriate insurance cover for your needs?

Financial Planning Advice

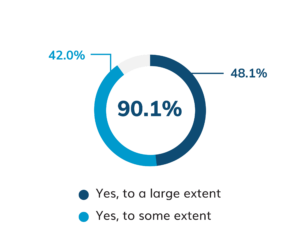

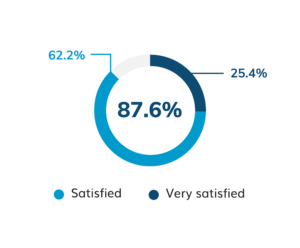

Customers of financial planning advice overwhelmingly agree (90.1%) that the services provided meet their needs. Satisfaction with financial planning advice is extremely positive, with almost nine in ten clients (87.6%) at least somewhat satisfied, and just over a quarter (25.4%) saying that they are very satisfied with the service provided.

Overall, are the services provided by your financial planner meeting your needs?

How satisfied were you with the service provided by the financial adviser who assisted you with arranging your financial planning?

Investment Advice

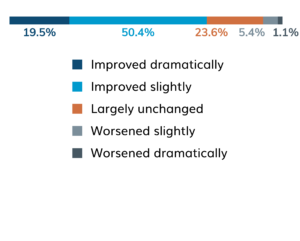

The decision on how much, where and how to invest can be difficult for a lot of New Zealanders. It’s therefore no surprise that the involvement of a financial adviser eases this burden. Over three quarters (77.3%) say it resulted in a better outcome for them, and a quarter (26.3%) of individuals who receive investment advice say that they were very satisfied with the service. Almost nine in ten (87.2%) were satisfied to some degree.

Do you believe you got a better outcome arranging your investments through an investment adviser than if you had purchased directly?

How has your financial security been impacted since you first received investment advice?

Full Results

The full research report can be read here. It includes a deep dive into each type of advice (mortgage, insurance, financial planning and investment), perceptions of the unadvised, commentary on preparedness for COVID-19 and some incredible statistics on how gaining financial advice has positivity helped clients’ mental health and family relationships.

Thanks

Thank you to the Financial Advice New Zealand Business Partners and for the generous grant from the PAA Legacy Trust who supported this research. The 2000 person research was design and managed by CoreData Research, a recognised global specialist in financial services research in July 2020.